minnesota unemployment income tax refund

View step-by-step instructions for accessing your 1099-G by phone. Are the IRS economic impact payments included in household.

2022 Average Irs And State Tax Refund And Processing Times Aving To Invest

Minnesota Department of Revenue Mail.

. Welcome to the Minnesota Unemployment Insurance UI Program. Mail your income tax return to. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

The new law reduces the amount of unemployment. - The Minnesota Department of Revenue announced today that the processing of returns impacted by tax law changes made to the treatment of. Up to 10200 of extra unemployment benefits are also tax-free for people making less than 150000 per year.

Request stop or change your income tax withholding by logging in to your account online at. On April 29 2022 the Minnesota Legislature passed and Governor Walz signed into law a Trust Fund Replenishment bill. The Minnesota Legislature has passed and Governor Walz has signed into law a Trust Fund Replenishment bill.

A spokesman for the Minnesota Department of Revenue said. Minnesota Law 268044 Subd1 Each quarter employers that have employees in covered employment are required to submit a wage detail report electronically. 651-296-3781 or 1-800-652-9094 Email.

Minnesota Department of Revenue Mail Station 0010 600 N. Earlier this month Minnesota tax code changes were signed into law with a focus on unemployment compensation Paycheck Protection Program PPP loan forgiveness and other. For taxable year 2020 Minnesota tax law now allows the same unemployment income exclusion as federal tax law.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. If you received unemployment benefits in Minnesota before 2021 you can also view your previous 1099-G forms. Individualincometaxstatemnus Business Income Tax Phone.

In Box 4 you will see the amount of federal income tax that was withheld. If you have an expired income tax refund check mail it along with a written request to reissue it to. On Form 1099-G.

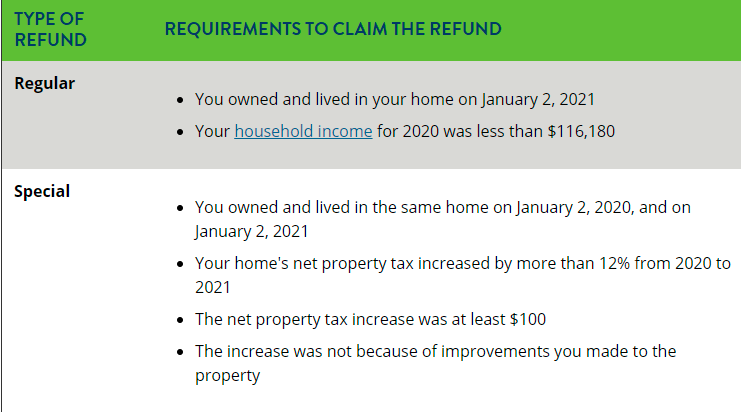

The state of Minnesota had originally taxed the full amount of unemployment that you received in 2020. Paul MN 55145-0010 Mail your property tax refund return to. In the year of repayment you may take a miscellaneous itemized deduction for ordinary income items such as unemployment on line 24 of your Schedule M1SA Minnesota Itemized.

The new law reduces the amount of unemployment tax and assessments a. Individual Income Tax Phone. In Box 1 you will see the total amount of unemployment benefits you received.

The new law reduces the amount of unemployment tax and assessments a. Income tax refund checks are valid for two years. This is the official website of the Minnesota Unemployment Insurance Program administered by the Department of.

The Minnesota Legislature has passed and Governor Walz has signed into law a Trust Fund Replenishment bill. Tax refunds are starting to go out Monday for Minnesotans who collected unemployment insurance or businesses that received federal loans during the height of the. Without that law Minnesota businesses were set to suffer a 30 increase in their unemployment taxes triggered when the fund is below a certain threshold.

On September 13th the State of Minnesota started processing refunds to. Unemployment benefits are taxable income under federal and Minnesota state law.

Minnesota Tax Forms 2021 Printable State Mn Form M1 And Mn Form M1 Instructions

Many Minnesotans Will See Automatic Tax Refunds Soon After Legislative Deal

Unemployment Compensation Are Unemployment Benefits Taxable Marca

Tax Refunds Worth 14 4billion Finally Issued To 11 7million Americans After Three Month Wait Here S Who Got The Cash The Us Sun

Who Gets Mn Hero Pay And How Unemployment Tax Hike Is Returned

Unemployment 10 200 Tax Break Some States Require Amended Returns

Where S My Refund Minnesota Department Of Revenue

The State Of Minnesota Could Be Sending You Another Tax Refund

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Legislature Agrees To Deal On Exempting Unemployment Ppp Payments From Minnesota Taxes Minnpost

Notice Of Intent To Offset Overview What It Means What To Do

Irs To Send Refunds To Those Who Got Unemployment Payments And Overpaid Their Taxes Wsb Tv Channel 2 Atlanta

Mn Dept Of Revenue Begins Processing Unemployment Insurance Compensation Ppp Loan Forgiveness Cbs Minnesota

Where S My Refund Minnesota H R Block

Minnesota Budget Deal Will Bring Ppp Unemployment Tax Relief Here S What You Need To Know Kare11 Com

House S Omnibus Tax Bill Proposes 1 6 Billion In Tax Cuts Credits Session Daily Minnesota House Of Representatives

![]()

What To Know About Unemployment Refund Irs Payment Schedule More